Active Members

A member’s start date with the City of Chicago determines that person’s “Tier” for the purpose of retirement benefits. A member who started working for the CPD prior to January 1, 2011 is considered a “Tier 1” participant and a member who started working for the CPD on or after January 1, 2011 is considered a “Tier 2” participant in the pension fund pursuant to Article 5 of the Illinois Pension Code. Every sworn police officer employed by the CPD contributes 9% of his or her salary, including duty availability, to the pension fund. This contribution is the same for both Tier 1 and Tier 2 members of the fund. The employee contribution is divided as follows:

- 7% for the employee annuity

- 1.5% for the widow annuity

- 0.5% for the annual increase in annuity

In addition, every sworn police officer contributes $2.50 per month to defray the cost of the ordinary death benefit.

The City of Chicago is required to contribute an actuarial determined amount to the Fund that is equal to and no less than the normal cost to the Fund and is sufficient to bring the total assets of the Fund up to 90% of the total actuarial liabilities of the Fund by the end of fiscal year 2055. Beginning in tax levy year 2020 the actuarial determined contribution is updated annually and is documented in the Fund’s annual actuarial report.

Tier 1 members

A police officer who started working for the CPD prior to January 1, 2011 is considered a “Tier 1” participant in the pension fund pursuant to Article 5 of the Illinois Pension Code.

Minimum Formula Annuities (40 ILCS 5/5-127)

Any participant having at least 20 years of service shall receive an annuity equal to 50% of the final average salary, plus an additional 2.5% of average salary for each year of service or fraction thereof beyond 20 years of service, however the annuity may not exceed 75% of such average salary. The final average salary is the highest 4 consecutive years of the last 10 years of service. A participant may withdraw with 20 years of service regardless of age. The annuity payment will begin when the participant reaches 50 years of age and has withdrawn from service. This service is reduced by any lost time at date of withdrawal. Note: If the Tier 1 member terminates before age 50 and does not apply for their annuity by their 50th birthday, then payment will begin when the member applies for retirement.Withdrawal at Mandatory Retirement Age (40 ILCS 5/5-129.1)

Active participants who are required to withdraw from service at the mandatory retirement age of 63 and have at least 10 but less than 20 years of service credit may elect to receive an annuity equal to 30% of their final average salary for the first 10 years of service plus 2% of their final average salary for each completed year of service or fraction thereof in excess of 10, but not to exceed a maximum of 48% of final average salary. The final average salary is the highest 4 consecutive years of the last 10 years of service. A participant whose retirement annuity is calculated under this section shall qualify for cost of living adjustment (COLA) increases.Withdrawal Before Age 50, 10 or More but Less than 20 Years of Service (40 ILCS 5/5-130)

A participant who withdraws from service with at least 10 but less than 20 years of service may receive a money purchase annuity equal to the sum of accumulated age and service contributions (7% of your pensionable salary) plus 10% of the city age and service contributions for each completed year of service after the first 10 years. The sum of the contributions is divided by a factor that is determined by the participant’s age at date of retirement and then converted into an annuity. The participant may also elect to receive a refund of contributions including 1.5% interest before turning 50 years old.Automatic Annual Increase

Tier 1 participants retiring with at least 20 years of service will receive an increase of 3% based on their originally granted annuity beginning on the later of; the 1st of the month after the participant reaches age 55, 1st of the month after the participant has been retired at least one year, or on 1/1/2023 with the signing of Public Act 103-0582. This annuity shall be increased by an additional 3% of the originally granted annuity each January 1st thereafter continuing for their lifetime.Tier 2 members

A police officer who started working for the CPD on or after January 1, 2011 is considered a “Tier 2” participant in the pension fund pursuant to Article 5 of the Illinois Pension Code.

Monthly Retirement Annuity

Tier 2 participants who have withdrawn from service, reached age 50 or more, and have 10 or more years of service, shall receive a Tier 2 Monthly Retirement Annuity. The calculation of a Monthly Retirement Annuity is equal to 2.5% of average salary for each year of service, subject to an annuity reduction factor of one-half of 1% for each month that the participant’s age at retirement is under age 55. The average salary is the highest 8 consecutive years of salary of the last 10 years of service. This service is reduced by any lost time at date of withdrawal. Monthly retirement annuities shall not exceed 75% of average salary. For Tier 2 participants, the annual salary starting January 1, 2011 shall not exceed $106,800; however, that amount shall be increased annually by the lesser of 3% including all previous adjustments or 1⁄2 of the annual unadjusted percentage increase (but not less than zero) in the Consumer Price Index-All Urban Customers (CPI-U) for the 12 months ending with the September preceding each November 1st including all previous adjustments. The annual salary cap for 2024 is $125,773.73.Automatic Annual Increase

The monthly annuity of a Tier 2 participant shall be increased on the January 1st occurring on or after the participant reaches age 60, or the 1st anniversary of the annuity start date. This annuity shall be increased each January 1st thereafter. Each annual increase shall be calculated at 3% or one-half of the annual unadjusted percentage increase (but not less than zero) in the consumer price index-u for the 12-month period ending with the September preceding each November 1, whichever is less, of the originally granted retirement annuity. If the annual unadjusted percentage change in the consumer price index-u decreases, then the annuity shall not be increased.REFUNDS

Refund of Employee Contributions (40 ILCS 5/5-163)

- A participant who withdraws before the age of 50 and a participant with less than 10 years of service who withdraws before age 57 is entitled to a refund of contributions with 1 ½% simple interest.

- A participant who is age 50 and eligible for a minimum formula annuity is not eligible for a refund of contributions.

- In the event of a participant’s death, if there is no surviving spouse the employee annuity and widow contributions in excess of the sum received by annuity or benefit shall be refunded to the participant’s children. If no children or descendants exist, the refund shall be paid to the estate of the participant.

Refund of Widow’s Annuity Contributions (40 ILCS 5/5-165)

- A participant who is unmarried at the time of retirement is entitled to a refund of contributions for the spousal annuity including 3% compounded interest.

- The widow of a participant who received a spousal refund is not eligible for a widow’s annuity, unless (1) the amount of the refund is repaid including 3% compounded interest within one year after the date of marriage and (2) the date of marriage is one year prior to the date of death.

Credit For Other Service (CFOS)

Credit for Other Service (40 ILCS 5/5-214)

An active participant in the PABF who has served with the CPD for at least 3 years, may be eligible to purchase service credit for various purposes for under state law for service prior to becoming a member or subsequent thereto for time periods specified in the statute.Prior Law Enforcement Service (40 ILCS 5/5-214.2)

An active participant in the PABF may be eligible to purchase service credit for prior service with Illinois municipal law enforcement agencies, as a law enforcement officer with any agency of the US government, and other certain law enforcement agencies as the statute permits. An active participant who was hired prior to the bill’s effective date, August 11, 2009, had until August 11, 2010 to make a formal application in order to satisfy the one year deadline. An active participant who became a member of the Fund after the effective date, August 11, 2009, may apply for credit within 2 years after his or her hire date and must provide the statutorily required contributions to the Fund within 5 years after the date of application.Military (40 ILCS 5/5-214.3 and 212)

Prior to Employment with CPD (40 ILCS 5/5-214.3)

Active participants who served in the Armed Forces of the United States prior to employment with the CPD may be eligible to purchase up to 2 years of service credits, in 1 month increments, for pension purposes. Interest is charged to purchase these credits. Please contact the Fund’s calculations group at benefits@chipabf.org or 312-235-4597 for more information.While on Leave of Absence from CPD (40 ILCS 5/5 -212)

Active participants who served in the Armed Forces of the United States while on leave of absence from the CPD may be eligible to purchase service time for annuity purposes prior to retirement. To receive credit, the participants must pay into the Fund the same amount that would have been deducted from their salary had they been active officers. Interest is not charged to purchase these credits.Credit for Service in the Chicago Fire Department (40 ILCS 5/5-213)

The PABF is a reciprocal fund with the Firemen’s Annuity and Benefit Fund of Chicago (FABF). Active participants may transfer contributions earned in the FABF to the PABF for the purpose of annuity service credit. The participant must apply to the PABF and provide payment of all statutorily required contributions.Disability Benefits

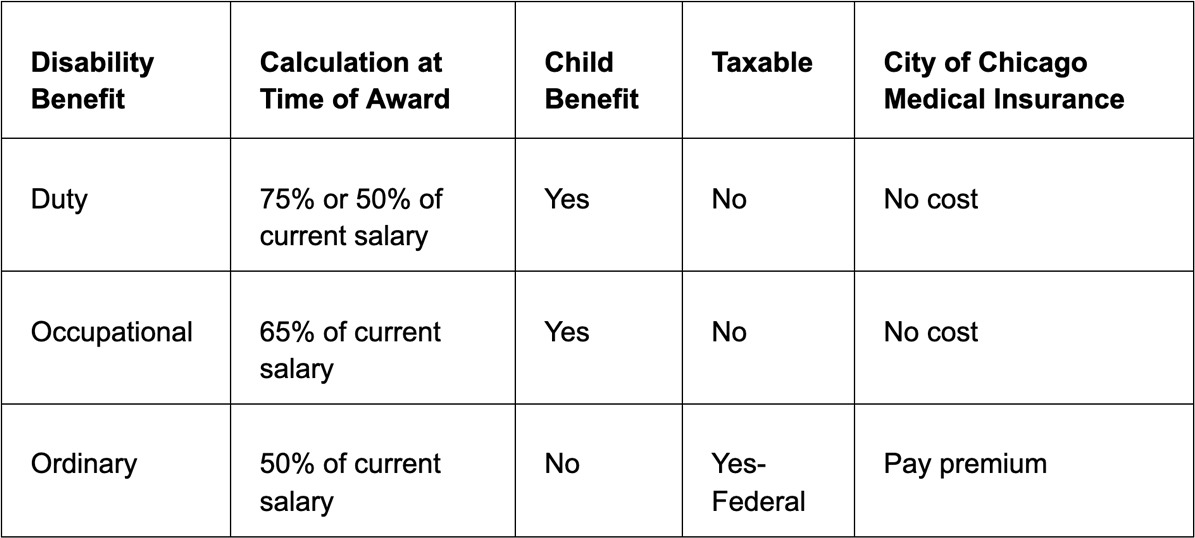

Active members are eligible to apply for duty, occupational or ordinary disability benefits after their medical time expires and they are removed from the CPD payroll due to a medical leave of absence. While on disability, participants are treated as though they are still active members for retirement and dependent annuity purposes pursuant to the Illinois Pension Code. When members begin receiving a disability benefit, they must comply with Board policies and statutory requirements related to the benefit. Failure to comply may result in suspension and/or termination of a disability benefit.

Duty Disability

Duty disability may be awarded if a member becomes disabled as the result of an injury incurred in the performance of an act of duty. An act of duty is defined by statute as “any act of police duty inherently involving a special risk, not ordinarily assumed by a citizen in the ordinary walks of life…” It is important to note that there is a distinction between becoming injured while in performance of an “act of duty” and becoming injured while at work. Not all injuries sustained in the ordinary course of a workday qualify as injuries occurring in the performance of an act of duty. A duty disability benefit award is 75% of the member’s salary at the time the disability is allowed unless the disability resulted from any physical defect or mental disorder or any disease which existed at the time the injury was sustained. In those cases, the duty disability benefit shall be limited to 50% of the member’s salary. This benefit also entitles the member to a child’s disability benefit of $100 per month for each natural or legally adopted, unmarried child under the age of 18 years old. If a member is receiving a duty disability benefit and believes his or her disability is of such a nature as to render the member totally disabled for any service of a remunerative character, that member may apply for a total and permanent disability benefit. This benefit is 75% of the member’s salary at the time of removal from the police department payroll. The duty disability benefit award is tax-free. Also, the City of Chicago will provide the member with free medical insurance coverage from the time he or she is awarded disability benefits. Any officer in receipt of a duty disability benefit is eligible to receive this benefit until such time he or she is found fit for duty, or until age 65 under the mandatory retirement rules of the department, at which time the officer would be eligible to apply for their pension.Occupational Disease Disability

Occupational disease disability (heart) may be awarded to a member who has suffered a heart attack or any other disabling heart disease. The member must have at least 10 years of service in order to be eligible for this benefit. An occupational disease disability award is 65% of the member’s salary at the time the disability occurs. This benefit also entitles the recipient to a child’s disability benefit of $100 per month for each natural or legally adopted, unmarried child under the age of 18 years old.

The occupational disease disability benefit award is tax-free. Also, the City of Chicago will provide the member with free medical insurance coverage when he or she is awarded occupational disability benefits.

Any member in receipt of an occupational disease disability benefit is eligible to receive this benefit until such time he or she is found fit for duty, or until age 65 under the mandatory retirement rules of the department, at which time the officer would be eligible to apply for his or her pension.Ordinary Disability

Ordinary disability benefits may be awarded to a member who becomes disabled as the result of any cause other than duty or occupational disease disabilities. The ordinary disability benefit award is 50% of the officer’s salary at the time disability occurs. Officers awarded an ordinary disability benefit are eligible for 1 year for every 4 years of service, with the maximum amount being 5 years. If awarded ordinary disability, there are no eligible children’s benefits available. Unlike the other categories of disability benefits, ordinary disability benefit payments are taxable by the federal government. Also, the City of Chicago Benefits Office will offer health insurance at a cost for members receiving ordinary disability benefits. Should the member choose the health insurance coverage, he or she will be required to make those premium payments directly to the Benefits Office.Applying for Disability Benefits

Every active officer is entitled to 365 days of medical time for each injury on duty and 365 medical days within a two-year period. While on the medical roll, a member should prepare for the possibility of applying for disability benefits and begin the disability application process within 2 months prior to expiring the 365 days of medical time. The following steps need to be completed in the order listed:- Contact the CPD Medical Services Section and notify them of your intention to apply for disability benefits.

- Complete a PAR (Personnel Action Request) Form and medical records release form allowing the Medical Section to copy and send your medical file to the Fund.

- Contact the Pension Fund and notify the disability manager of your intention to apply for disability benefits.

- Complete your application with the Fund after the disability manager contacts you to notify you that the Fund has received your medical files.

- Attend an appointment for examination by a Fund physician.

Proof of Disability – Physical Examinations (40 ILCS 5/5-156)

Participants receiving disability benefits shall be examined at least once a year, or longer periods as determined by the Board, by a Board appointed physician. However, the Board has the right to request an examination of any disability participant as deemed necessary.

In cases where the Board requests an applicant to get a second opinion, the applicant must select a physician from a list of qualified licensed and practicing physicians who specialize in the various medical areas related to duty injuries and illnesses, as established by the Board. The Board may require other evidence of disability.

As part of the re-examination process, all disability participants who are working outside of CPD must submit a job description. When a disability ceases, the Board shall discontinue payment of the benefit.

Disability Benefits Comparison Chart

Dependent Benefits

Ordinary Death Benefits

The Fund pays an ordinary death benefit to the designated beneficiary or beneficiaries of deceased participants.

Active Officer:

- The benefit is between $6,000 and $12,000.

- If an active officer’s death is before age 50, the benefit is $12,000. After the age of 50, the benefit is reduced by $400 for each year the officer remains in active service but not reduced below $6,000.

- If the death results from injury in the performance of an act or acts of duty prior to retirement, the amount of benefit payable is $12,000.

Retired Officer: If the officer’s death occurs while in receipt of a retirement annuity, the benefit is $6,000. In order to be eligible for this benefit, a participant must have terminated employment with CPD after age 50 and applied for their annuity within 60 days of resigning from CPD.

Annuities for Widows

Eligibility Requirements

Eligibility for widow and surviving spouse annuities require the spouse be married for at least one year to the Active/Retired participant at the date of death. The one year requirement does not apply when an officer dies in the line of duty. In accordance with Illinois law, civil union partners are eligible for the same benefits as widows and spouses of participants.

Marriage on Disability or Retirement

A widow who marries a participant in receipt of disability benefits may be eligible for a widow’s annuity provided they were married for at least one year prior to the participant’s death.

The widow of a participant who receives a refund of contributions for widow’s annuity at the time of retirement is not eligible for widows benefits unless the refund is repaid to the Fund, with interest at a rate of 3% per year compounded annually, from the date of the refund to the date of repayment. The marriage must exist for at least one year prior to the participant’s death for a spouse to become eligible for benefits. Benefits commence upon death of the participant and receipt of the repayment.

Widow’s Annuities Benefit Tiers

Tier 1 widow’s annuities are for widows of members who began working for the CPD prior to January 1, 2011. Tier 2 widow’s annuities are for widows of members who began working for the CPD on or after January 1, 2011.

Death in Service (In the performance of an act of duty) – Tier 1 and Tier 2

- If an officer’s death is the result of an injury incurred in the performance of an act or acts of duty, the officer’s widow is entitled to an initial annuity equal to 75% of the salary the member would have ordinarily been paid at time of death.

- The widow’s annuity (75% of the member’s current salary) will be revised at any salary increase and longevity raise the member would have been entitled to if they would have be in active discharge of their duties until reaching the age 63.

- Once the widow’s annuity reaches the member’s 63 birthday, the widow’s annuity will remain fixed until the widow’s death.

Death in Service (Non-duty related)

Tier 1 Widows

If the deceased member was an active police officer at the time of death and had at least 1 1/2 years of creditable service, the widow’s annuity will be the greater of:

- 30% of the annual maximum salary attached to the classified civil service position of a first class patrolman at the time of his death; or

- 50% of the retirement annuity the deceased member would have been eligible to receive if he had retired from service on the day before his death.

This annuity is fixed at the time of the member’s death and does not increase.

Tier 2 Widows

Minimum 1 ½ years and less than 10 years of serviceIf the deceased member was an active police officer with at least 1 ½ but less than 10 years of service at the time of death, the Tier 2 surviving spouse’s annuity will be 30% of the annual maximum salary attached to the classified civil service position of a first class patrolman at the time of his death.

10 years of service or more

If the deceased policeman was not receiving an earned annuity but had at least 10 years of service at the time of death, the Tier 2 surviving spouse’s will be the greater of:

- 30% of the annual maximum salary attached to the classified civil service position of a first class patrolman at the time of his death; or

- 66 2/3% of the Tier 2 monthly retirement annuity that the deceased policeman would have been eligible to receive.

The surviving spouse’s annuity will increase by 3% or one-half the annual unadjusted percentage increase (but not less than zero) in the Consumer Price Index for All Urban Consumers (CPI-U) for the 12 months ending with the September preceding each November 1, whichever is less, of the originally granted Tier 2 surviving spouse’s annuity. The increase will take effect on the January 1 next occurring after the:

- Recipient of the Tier 2 surviving spouse’s annuity reaches age 60; or

- First anniversary of the Tier 2 surviving spouse’s annuity start date, whichever is later, and on each January 1 thereafter.

Retired Member Death

Tier 1 Widows

If the deceased member was receiving a retirement annuity at the time of death, the widow’s annuity will be equal to 50% of the member’s annuity. The annuity is not subject to the automatic annual increase.

Tier 2 Widows

If the deceased member was receiving an earned annuity at the date of death, the Tier 2 surviving spouse’s annuity will be 66 2/3% of the member’s earned annuity at the date of death.

This surviving spouse’s annuity will increase by 3% or one-half the annual unadjusted percentage increase (but not less than zero) in the Consumer Price Index for All Urban Consumers (CPI-U) for the 12 months ending with the September preceding each November 1, whichever is less, of the originally granted Tier 2 surviving spouse’s annuity. The increase will take effect on the January 1 next occurring after the:

- Recipient of the Tier 2 surviving spouse’s annuity reaches age 60; or

- First anniversary of the Tier 2 surviving spouse’s annuity start date, whichever is later, and on each January 1 thereafter.

Minimum Widows Annuities – Tier 1 and Tier 2

Beginning January 1, 2017, the minimum widow’s annuity under this Article will be no less than 125% of the Federal Poverty Level for all persons receiving widow’s annuities on or after that date.

Annuities For Children

Tier 1 and Tier 2

A child’s annuity is provided for unmarried natural or adopted children of police officers, payable monthly, from the date of death until the child’s attainment of age 18 except as limited by the provisions of 40 ILCS 5/5-152. Child annuities will be paid in an amount equal to:- 10% of the annual maximum salary attached to the classified civil service position of a first class patrolman on the date of the officer’s death for each child while a widow or widower of the deceased policeman survives; or

- 15% of the annual maximum salary attached to the classified civil service position of a first class patrolman on the date of the officer’s death while no widow or widower shall survive.

Family Maximums

- The combined annuities for the family of a member whose death resulted from an act of duty, shall not exceed the salary that would ordinarily have been paid to him if he had been in the active discharge of his duties.

- The combined annuities for the family of a member whose death resulted from any cause other than the performance of an act of duty, shall not exceed an amount equal to 60% of the salary that would ordinarily have been paid to him if he had been in the active discharge of his duties.

Annuities For Parents

A parent’s annuity may be available to the natural parent or parents of a member as a result of the member’s death if there is no surviving spouse or child entitled to an annuity. In order to award a parent’s annuity, the Board must receive satisfactory proof that the member was contributing to the support of the parent or parents at the time of death. Upon proving support, each eligible surviving parent’s annuity will be 18% of the current annual salary attached to the classified position held by the member at the time of death or withdrawal from service.

RETIRED MEMBERS

Keep the Fund Updated

It is important for annuitants to notify the Fund about address changes as soon as possible. Just complete a Change of Address form, sign, and return to our office via email to retirement@chipabf.org or by mail.

In addition, if you need or want to make any banking information or tax changes, the printable forms are also available on our website. All changes must be signed by the annuitant or they will not be accepted. Just complete the appropriate form, sign, and return to our office via email to retirement@chipabf.org or by mail.

Healthcare Insurance Premium Deduction

As an eligible “retired public safety officer” as defined by the IRS within the Pension Protection Act of 2006, Fund annuitants may deduct up to $3,000 per year from their taxable income for healthcare premiums paid directly from retirement assets.

At the annuitant’s request, the Fund will deduct a specified monthly healthcare insurance premium amount from the annuitant’s monthly annuity benefit, and pay such amount to a designated healthcare insurance provider as authorized by an annuitant member. The amount excluded from income is the smaller of the amount of the premiums or $3,000. It is important to note that this tax treatment is afforded only to the retired member and not a surviving spouse.

The Fund serves only as a conduit to collect and forward payment of premiums authorized by the participant from the participant’s benefit check to eligible health care plans. The authorization forms necessary to process such payment of health care premiums are available on the Forms section of the website.If you have questions about the deduction, please contact the Fund office to discuss the Fund’s requirements for the process.

Please be advised:

1. Premium payments made by the Fund to the annuitant’s healthcare insurance provider will begin the first (1st) month after the Fund receives a fully completed and signed form, provided the completed and signed form is returned to the Fund’s office by the fifteenth (15th) of the month. Annuitants are responsible for making all premium payments to his/her healthcare insurance provider until the Fund approves and processes the completed and signed form. Incomplete and/or unsigned forms will not be processed and the annuitant will be notified they must resubmit the form prior to the Fund processing any premium payment to his/her healthcare insurance provider. Annuitants should be aware that certain Insurance carriers will not accept payments from third parties such as PABF.

2. The Northern Trust will mail the annuitant’s healthcare insurance premium directly to the designated healthcare insurance provider 5 days prior to the last business day of each month regardless of the premium due date.

3. If an annuitant’s monthly healthcare premium exceeds his/her monthly annuity benefit, the annuitant cannot participate in this process, and the annuitant is advised to contact his/her healthcare insurance provider to discuss his/her payment options.

4. Annuitants are responsible to advise the Fund in writing, of any changes in the amount of the Premiums to be paid by the fifteenth (15th) day of the month that the payment is made. Unfortunately, many Insurance companies will not provide timely premium notices directly to the Fund to allow for changes in the amount of premium to be paid.

All questions concerning eligibility or plan coverage should be directed to the health insurance plan provider.Healthcare Subsidy Eligibility

Pursuant to Court order and current law, all eligible City of Chicago employee annuitants (both current and future employee annuitants, but not spousal or child annuitants) of the Fund are entitled to receive a health insurance premium subsidy of:

- $55 per month if the annuitant is not qualified to receive Medicare benefits; or

- $21 per month if the annuitant is qualified to receive Medicare benefits.

To be eligible:

Annuitant must have retired on or after August 23, 1989;

Annuitant must have been hired prior to June 30, 2003; and

Annuitant must participate in a group healthcare plan* for which the PABF deducts the health insurance premiums from the annuitant’s monthly annuity. All eligible subsidy payments will be included in the annuitant’s respective monthly annuity payment. If you have any questions regarding the healthcare subsidy, please contact the Fund at hcsubsidy@chipabf.org or Angela at 312-676-0417.

*Current group healthcare plans include: (i) the Blue Cross/Blue Shield plans sponsored by the City of Chicago; (ii) the Aetna plans sponsored by the Fraternal Order of Police Chicago Lodge 7; and (iii) the United American Insurance Co. plans sponsored by the Chicago Police Sergeants’ Association.

Tier 1 Annuitants Automatic Annual Increases (aka COLA)

Participants Born Before January 1, 1966Tier 1 participants born before January 1, 1966, retiring with at least 20 years of service will receive an increase of 3% based on their originally granted annuity beginning on the later of the 1st of the month after the participant attains age 55 or, the 1st of the month after the participant has been retired at least one year. This annuity shall be increased by an additional 3% of the originally granted annuity each January 1st thereafter continuing for their lifetime.

Participants Born On or After January 1, 1966Tier 1 participants born on or after January 1, 1966 will receive an increase of 1.5% based on their originally granted annuity beginning on the later of the 1st of the month after the participant attains age 60 or, the 1st of the month after the participant has been retired at least one year. This annuity shall be increased by an additional 1.5% of the originally granted annuity each January 1st thereafter for a maximum of 20 increases or 30%.

312.744.3891

312.744.3891